The Aussie and Kiwi dollars are up 1% this morning as reports on President Trump’s inauguration day indicate tariffs won’t be enforced on day one of the new administration. China’s authorities are preparing their financial markets for when trade restrictions do come into force.

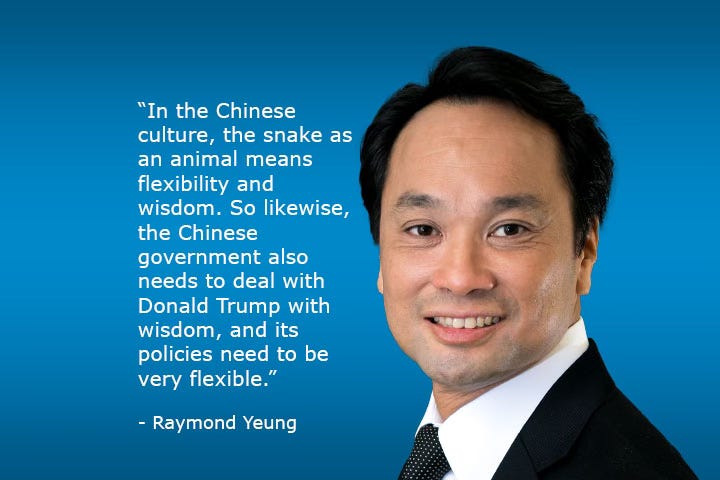

In our bonus deep dive interview, ANZ’s Chief Economist for Greater China Raymond Yeung previews what to expect in the Year of the Snake.

5 things to know in 5 minutes:

US markets were closed for Martin Luther King Day, although the US dollar dropped around 1% overnight as reports emerged that incoming US President Donald Trump may not impose tariffs on day one of his administration, instead ordering a study into trade practices. ANZ Head of G3 Economics Brian Martin says there is still a ‘wait-and-see’ factor hanging over the development.

Brian says markets remained focused on what executive orders will be signed following Trump’s inauguration this morning Sydney/Melbourne time, including on immigration policy.

China’s onshore market between banks for cash and other securities has tightened significantly, with interbank payments delayed last Wednesday and the overnight benchmark rate rising to the upper bound of the official rate corridor at 2.5%, up from 1.5% earlier in January. ANZ’s Senior China strategist Zhaopeng Xing says the authorities in Beijing want to reduce leverage in the market, just in case.

Zhaopeng says this engineered tightness could continue well into next month.

In New Zealand this week, ANZ Senior Economist Miles Workman is forecasting an annual Q4 inflation rate of 2.2% - unchanged from Q3 and just above the Reserve Bank’s 2.1% forecast due to slightly higher tradable inflation. Miles says key to watch though are non-tradable and core inflation measures.

Cheers,

Bernard

PS: Catch you tomorrow with the key market moves following Donald Trump’s inauguration.