The RBA is expected to hike one more time later today, which is helping the Aussie dollar nudge up towards 65 USc in early trade.

In our bonus deep-dive interview, ANZ’s Chief Economist for Southeast Asia and India, Sanjay Mathur, looks at why Indian equities are undervalued.

5 things to know

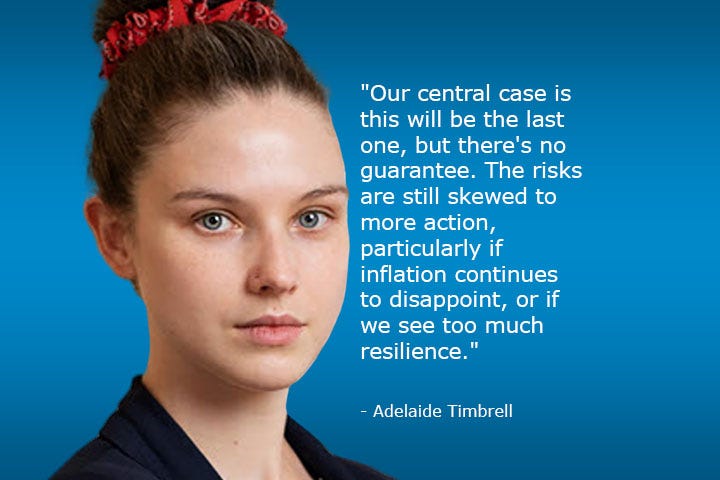

The RBA is expected to hike 25 basis points to 4.35% at 2.30 pm AEST today, says ANZ Australia Senior Economist Adelaide Timbrell.

Adelaide says it’s probably the RBA’s last hike, but the risks are skewed towards hiking again rather than cutting any time soon.

Global markets were mixed overnight. The S&P 500 was flat at 5am AEST, while the US 10-year yield was up eight basis points at 4.64%. Brent crude rose almost a dollar a barrel to US$87 after Saudi Arabia and Russia confirmed they were extending their production cuts.

The Aussie (64.99 USc) and Kiwi dollars (59.72 USc) have risen solidly in the last week, thanks to both rising expectations of an RBA hike and US dollar weakness as confidence grows that the Fed is about to pause, says ANZ’s Head of FX Research Mahjabeen Zaman.

Indonesian GDP grew at an annual rate of 4.94% in Q3, which was below forecasts, but ANZ Asia Economist Krystal Tan says growth wasn’t weak enough to change the central bank’s view.

Cheers

Bernard

Look out tomorrow for the details from the RBA’s decision.