Gold jumps to new highs. China’s banks cut lending rates more than expected to jolt demand. Iron ore and oil prices fall after China stimulus disappointment, and the RBA is encouraged by rate cut bets being pushed out after strong jobs data.

In our bonus Deep Dive interview, ANZ Chief Economist for Greater China Raymond Yeung explains why investors weren’t too keen on China’s recent property support package.

5 things to know:

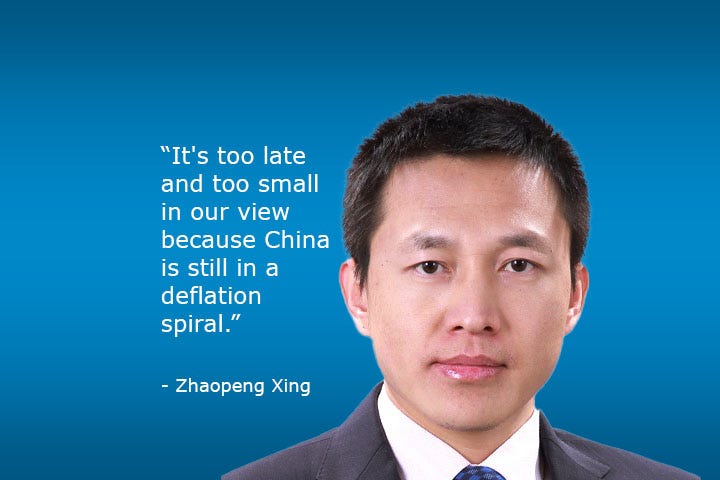

Global stocks fell around 0.5% overnight as US Treasury yields kept rising on sliding expectations of Fed cuts. Gold leapt to a record high of US$2,755/oz. Also, Chinese banks yesterday cut their key one and five-year lending rates by 25 basis points. ANZ Senior China Strategist Zhaopeng Xing says that was more than the market expected, and five basis points more than the PBoC’s cut.

Zhaopeng says further economic support is needed in China, but it isn’t likely to come from the central bank, leaving the work to fiscal measures.

RBA Deputy Governor Andrew Hauser has said the response of market interest rates to recent data was encouraging. Market bets for the first cut pushed out to April 2025 from November after strong jobs data. ANZ Head of Australian Economics Adam Boyton says that’s not too surprising.

That disappointment in China’s recent stimulus efforts flowed through iron ore. It fell on the day property market measures were announced last week, says ANZ Senior Commodity Strategist Daniel Hynes.

Daniel says the disappointment also pushed oil prices down last week. Brent crude was trading this morning at, US$74.16/bbl, up 1.4%, after being closer to $80/bbl ten days ago.

Cheers

Bernard

PS: Catch you tomorrow with a look at how Australian consumers might be feeling as those RBA rate cut expectations get pushed out. Thanks to Alex Tarrant for filling in for me while I was away on family leave.