The Reserve Bank of New Zealand cuts by 50 basis points and markets price another outsized move in November. Attention turns to US inflation data after last week’s strong jobs report. The Reserve Bank of India holds, but moves to a neutral stance.

In our bonus Deep Dive interview, as China’s Finance Ministry announces a fiscal policy briefing for Saturday, ANZ Chief Economist for Greater China Raymond Yeung analyses the growth prospects for China’s economy.

5 things to know:

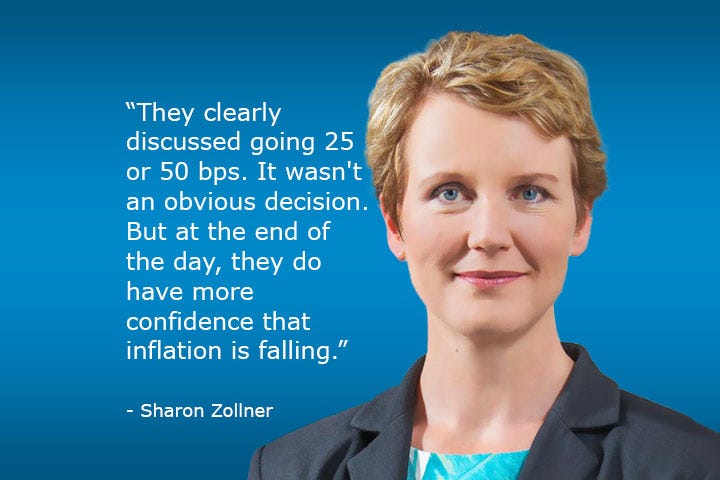

The Reserve Bank of New Zealand delivered a 50 basis point cut to its Official Cash Rate yesterday, lowering the benchmark to 4.75%, in line with market expectations. ANZ New Zealand Chief Economist Sharon Zollner says the oversized move was based on increased confidence that inflation is on its way back to the middle of the RBNZ’s 1-to-3% target band.

Sharon says recent high frequency data provided the RBNZ rate setting committee additional confidence that price growth is declining.

All eyes are now on what the RBNZ does in November - its next decision after that will be in February. Sharon and the markets are picking a 50bps cut, but inflation and jobs data between now and November could throw up some surprises.

In global markets, the S&P 500 has hit a fresh record high as investors turn their attention to the US Fed’s inflation mandate. ANZ Head of G3 Economics Brian Martin says US CPI data tonight is expected to show a 0.1% rise in September.

The Reserve Bank of India opted to hold at 6.5% yesterday. ANZ Economist Dhiraj Nim says the RBI downgraded a previous hawkish stance to ‘neutral’, paving the way for a December cut.

Cheers

Alex

PS: Bernard is away today on family leave. Catch you tomorrow with analysis of US inflation data and what that could mean for the Federal Reserve’s rate cut path.