US jobs growth was much weaker than expected in October, but the Fed is still on track to cut rates 25 basis points later this week. December is not as certain for another cut though. And watch out this week for more stimulus news from China.

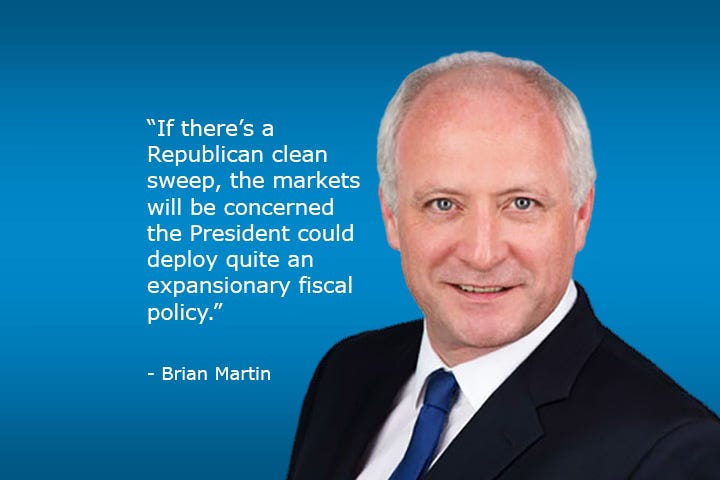

In our bonus Deep Dive interview, ANZ Head of G3 Economics Brian Martin teases out how the Fed, financial markets and bond investors view a Harris win, or a Trump win.

5 things to know:

US jobs growth of 12,000 in October vs forecasts of about 100,000 surprised. US stocks rose. US Treasury yields surged on fears of loose fiscal policy. ANZ Head of G3 Economics Brian Martin highlights a downward revision of 122,000 jobs for September and August.

Brian says the data leaves the prospect of a 25 basis point cut by the Fed intact, but another one in December is no sure thing.

Another factor to watch this week is China’s stimulus programm. ANZ’s Group Chief Economist for Greater China Raymond Yeung says market expectations are for a 10 trillion yuan announcement, but urges caution on that number.

Gold has been firm ahead of the US elections amid talk of renewed geopolitical uncertainty, says ANZ Senior Commodities strategist Daniel Hynes.

One reason for gold’s strength is ongoing central bank buying from the likes of Russia, Iran and China on fears any conflict may lead to US dollar asset seizures.

Cheers

Bernard

PS: The US elections will dominate our coverage of global financial markets and the global economy this week.