The US labour market remains resilient, while UK and European production is still contracting. South Korea growth disappoints as exports drag, and Japan’s Finance Minister raises concerns as the yen slides against a resurgent US dollar

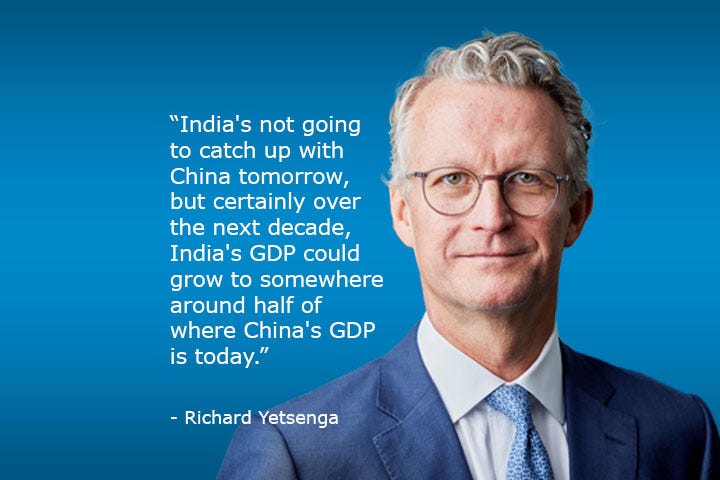

In our bonus Deep Dive interview, ANZ Chief Economist Richard Yetsenga looks at what China might learn from its current economic support efforts, and how quickly India might catch up.

5 things to know:

The US economy’s soft landing just gets softer and softer, and seems to be barely landing at all. US PMI and jobless claims figures overnight were better than expected, indicating ongoing strength in the labour market. That contrasted with PMI survey results showing contractions in Europe and the UK. Global markets were mixed, with the Nasdaq and S&P 500 up with a surge in Tesla.

Japan’s PMIs dropped into contraction territory. ANZ FX Analyst Felix Ryan says there were some positives on inflation for the Bank of Japan as it looks to normalise policy.

Yesterday the Yen weakened to a point where 153 yen were needed to buy a US dollar, although overnight it settled at 151.75. Felix pointed to Japan’s Finance Minister warning authorities would closely monitor the currency’s moves.

South Korea’s GDP disappointed in Q3, rising just 0.1% in the quarter compared to the market forecast of 0.4%. ANZ Economist Krystal Tan says it was the export side of the economy which took the hit, with goods exports down 0.6%.

Malaysia’s annual CPI inflation rate fell to 1.8% in September from 1.9% in August, where it had been for five months in a row. Markets forecast 1.9%. ANZ Economist Arindam Chakraborty says inflation is broadly stable for now, but the removal of fuel subsidies next year will be a key moment for monetary policy.

Cheers

Bernard

PS: Catch you next week with a Bank of Japan rate decision and Q3 inflation data in Australia.