Global markets are mixed ahead of US PCE data tonight. US bond yields slide from highs, dragging the US dollar down. New Zealand’s new Government delivers tax cuts and more borrowing, which may worry the Reserve Bank.

In our bonus deep dive interview, ANZ Pacific Economist Kishti Sen explains why he believes Fiji has a three-speed economy.

5 things to know:

US bond yields fell 6-7 bps from their Wednesday highs ahead of US PCE inflation data tonight, which is the Fed’s preferred measure. The US dollar fell vs the Aussie, Kiwi, yen and euro. ANZ Economist Bansi Madhavani points to Fed comments overnight suggesting inflation is on track to its target.

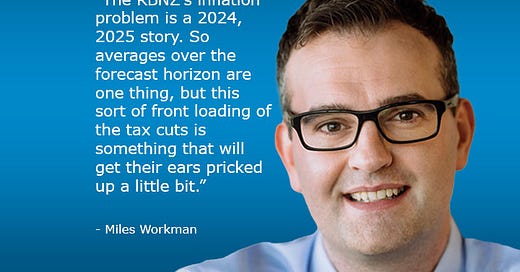

New Zealand’s new Government delivered its promised income tax cuts, funded by lower government operating spending. The Government suggested this could be disinflationary because some people might save their windfalls. But ANZ Senior Economist Miles Workman says higher capital spending and the July 31 start of income tax cuts indicate short-term upside risks for CPI inflation.

New Zealand’s return to a budget surplus has been pushed out a year to 2027/28, partly due to forecasts of lower economic growth and inflation. The NZ Debt Management Office increased its bond programme by $12 billion over the next four years, broadly in line with market forecasts.

US PCE inflation data for April is due tonight. It will be the last major data point ahead of the FOMC meeting on June 11/12. Eurozone CPI data is also due tonight.

India’s Q1 GDP is expected to grow 6.2% year on year, according to the consensus. ANZ Economist Dhiraj Nim is expecting a 7% rise, driven by construction investment, before GDP growth tapers off later in the year.

Cheers

Bernard

PS: Catch you next week with reaction to the US PCE and Europe inflation data.