Traders are bracing for hits to the yen and the Nikkei after surprising losses for Japan’s ruling party in election results overnight. Japan’s inflation is firming in line with Bank of Japan hopes, and US non-farm payrolls are the big figures to watch this week.

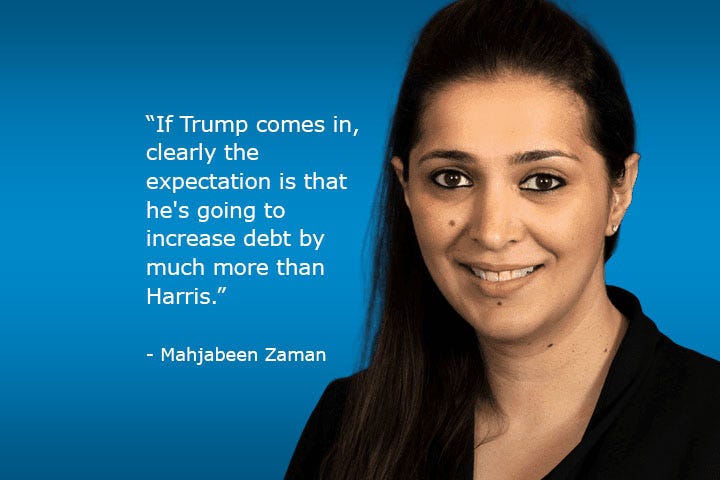

In our bonus Deep Dive interview, ANZ’s Head of FX Research Mahjabeen Zaman looks at the Trump trade in global currency and bond markets.

5 things to know:

Surprise losses for the ruling Liberal Democratic Party in Japan have put traders on edge for falls in the yen and Nikkei. However, ANZ’s Head of FX Research Mahjabeen Zaman says the Bank of Japan’s approach to inflation is likely to remain separate from whoever is in charge.

Japan’s relatively weak economy was a factor in the poor election results for the ruling party. Data out on Thursday showed Japan’s manufacturing sector sagging. But inflation data for Tokyo on Friday showed some core inflation coming through, as the Bank of Japan wants, ANZ FX Analyst Felix Ryan says.

The big economic data this week is from the United States on Friday with Non Farm Payrolls, says ANZ Group Chief Economist Richard Yetsenga.

American consumers remain grumpy about the state of the US economy, but it remains objectively more robust than the rest. Richard explains why.

New Zealand consumer confidence fell in October for the first since June. ANZ New Zealand Economist Sharon Zollner says a sustained recovery will take some time as the jobs market lags falling interest rates.

Cheers

Bernard

PS: Catch you tomorrow with a look ahead to key inflation figures for Australia due on Wednesday.