The RBA turns more hawkish, saying it considered a rate hike but not a cut when it met yesterday. Weak US retail sales give hope for two Fed rate cuts this year, and strong Euro services inflation sees ANZ reduce its call on ECB rate cuts in 2024.

In our bonus deep dive interview, ANZ New Zealand Economist Henry Russell continues his analysis of sticky domestic inflation and how it worries the Reserve Bank of New Zealand.

5 things to know:

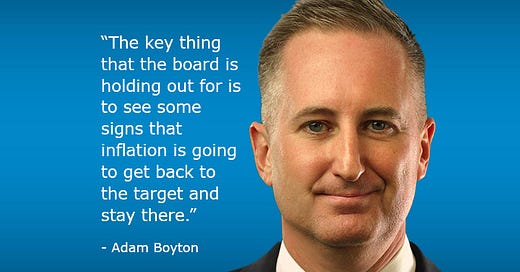

The RBA held the cash rate at 4.35% yesterday, but its statement was more hawkish than expected, says ANZ Head of Australian Economics Adam Boyton.

RBA Governor Michele Bullock said the RBA board considered a rate hike, but not a cut at this meeting. Adam says it’s clear the RBA is in no hurry to cut rates.

US Treasury yields fell and equities rose slightly as weak US retail sales data pushed up expectations that the Federal Reserve can make two rate cuts this year. ANZ Head of G3 Economics Brian Martin says demand in the US economy is softening, which should give the FOMC comfort.

Final European CPI inflation came in steady at 2.6% year-on-year in May. Services inflation of 4.1% was up from 3.9% in April. Brian says that services inflation is being backed by recent wage growth, and expects the ECB will now only make two additional rate cuts in 2024, down from four previously.

May CPI data for the UK is due later today. ANZ Economist Bansi Madhavani says the headline rate is forecast to fall to around 2%. But the Bank of England will be watching services inflation, which has been near 6% in recent months.

Cheers

Bernard

PS: Catch you tomorrow with those UK CPI numbers and a look ahead to the Bank of England’s policy rate decision and a preview of New Zealand’s Q1 GDP.