US jobs growth was weaker than expected, so US bonds and stocks rallied. US Treasury yields and the US dollar fell. The RBA is expected to hold hawkishly tomorrow.

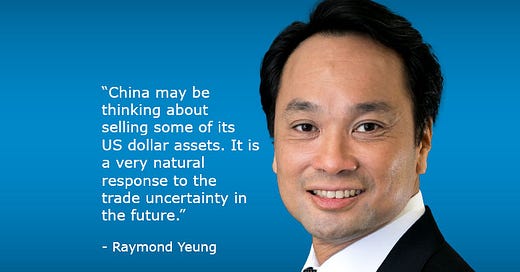

In our bonus deep dive interview, ANZ Chief Economist for Greater China Raymond Yeung looks at what a re-election of Donald Trump could mean for the US-China bilateral relationship.

5 things to know:

US jobs grew 175,000 in April, which was below market expectations for a rise of 240,000. Annual earnings growth also slowed, reinforcing views the Fed can cut this year. The US 2-year Treasury yield fell 7 bps to 4.80%, dragging the USD down vs the Aussie and Kiwi dollars.

ANZ Group Chief Economist Richard Yetsenga says the US dollar is looking expensive in the medium term against the yen.

The Reserve Bank of Australia is expected to hold its cash rate at 4.35% tomorrow afternoon, albeit hawkishly, says Richard.

ANZ Head of FX Research Mahjabeen Zaman says she’ll be watching Ministry of Finance reserves data in Japan this week for any confirmation of yen intervention.

US Treasury Secretary Janet Yellen has kept everyone guessing on a “rumour” of yen intervention, saying only: “we would expect these interventions to be rare and consultation to take place.”

Cheers

Bernard

PS: Catch you tomorrow with part two of our deep-dive interview with Raymond Yeung on what a second Donald Trump Presidency might do for US-China relations, and in particular the US dollar and US Treasury yields.