US stocks sold off sharply on Friday night and US bond yields fell to one-year lows after weaker than expected nonfarm payrolls data. All eyes are on the RBA tomorrow for any signs of a dovish pivot. South Korea’s inflation was hotter than expected.

In our bonus deep dive interview, ANZ NZ Senior Economist Miles Workman unpacks a downgrade in ANZ Research’s forecast track for NZ house prices.

5 things to know:

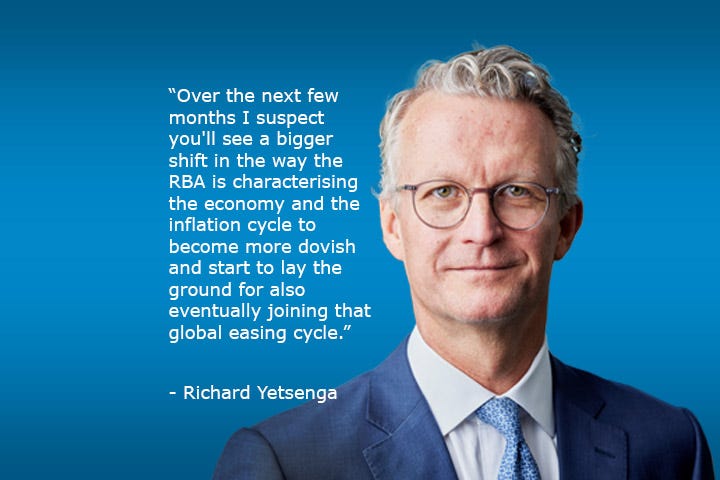

US stocks fell sharply on Friday night and the US 10-year Treasury yield fell 11 bps to 3.79% after lower-than-forecast growth in US jobs in July. ANZ Group Chief Economist Richard Yetsenga says the data supports market views of the Fed cutting from September.

Richard expects no change from the RBA in its rates decision tomorrow, but notes markets will be watching for a tonal shift from hawkish to dovish.

He thinks financial markets are getting ahead of themselves in pricing a rate cut by the end of the year.

South Korea’s inflation data on Friday was surprisingly robust at 2.6% in July from a year ago. ANZ Economist Krystal Tan sees monetary policy on hold for now.

Australian housing lending rose 1.3% in June from May, which was more than markets expected. ANZ Senior Economist Blair Chapman says average loan sizes increased with house prices, partly as investors borrowed more.

Cheers

Bernard

PS: Catch you tomorrow with a closer look-ahead to the RBA decision and New Zealand jobs data due on Wednesday.