All eyes are on US non-farm payrolls data tonight. Australian households spent plenty going to Taylor Swift concerts. Building approvals weaken on both sides of the Tasman. Kiwi house values track sideways.

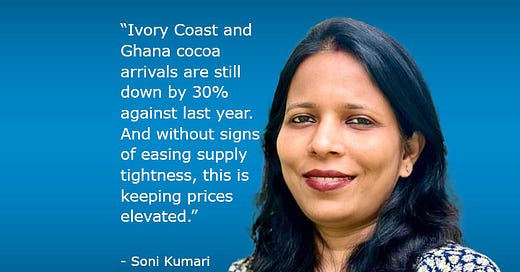

In our bonus deep dive interview, ANZ Commodities Strategist Soni Kumari looks at why you paid so much more for your Easter eggs this year: a soaring cocoa price.

5 things to know:

The consensus is for US jobs growth of 200,000 in March, down from 275,000 in February. ANZ Head of G3 Economics Brian Martin says it will take quite a miss to rumble markets.

Spending by Australian households was up 3.6% in February from a year ago. ANZ Economist Maddy Dunk says that was led by non-discretionary spending, although a big player in the month was the Taylor Swift effect.

Australian building approvals unexpectedly fell 1.9% in February and were down nearly 6% from a year ago. Maddy says approvals are near decade lows.

New Zealand dwelling consents were also down 6% in February from a year ago. ANZ Senior Economist Miles Workman says this indicates monetary policy is working, but New Zealand needs to build more houses.

However, New Zealand house values are tracking sideways. Corelogic data shows the average value was up 0.1% in February from a year ago. Miles says the outlook isn’t too flash for house prices over the next year.

Cheers

Bernard

PS: Catch you next week with reaction to those US non-farm payrolls.